Epigenetic Orchestra: Unraveling the Intricate Functions of Epigenetic Regulation

In the intricate dance of genetics, a silent conductor exists, orchestrating the nuances of gene expression – epigenetic regulation. This article delves into the captivating world of epigenetics, seeking to unravel the multifaceted functions that this molecular maestro performs in shaping our biological symphony.

Epigenetics Unveiled:

Epigenetics, or changes above genetics, involves heritable modifications in gene activity without altering the DNA sequence. This molecular control layer influences gene activation, playing a key role in cellular development, differentiation, and environmental response.

Developmental Choreography:

One of the primary functions of epigenetic regulation is its involvement in the intricate choreography of development. Genes need precise activation or silencing during organism evolution in specific cells and times. Epigenetic modifications, like DNA methylation and histone changes, orchestrate gene expression patterns crucial for proper development.

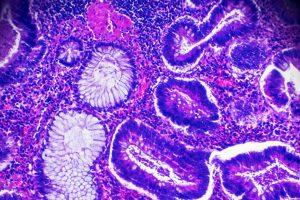

Cellular Identity and Specialization:

Epigenetic regulation plays a pivotal role in determining cellular identity and specialization. While every cell in our body carries the same genetic code, the epigenetic marks on the DNA and histones dictate which genes are accessible or closed off. This process ensures that a liver cell functions as a liver cell, a neuron as a neuron, and so forth. Epigenetic modifications act as the blueprint for cellular specialization, preserving the distinct identity of each cell type.

Environmental Responsiveness:

Epigenetic mechanisms serve as the cellular memory, responding to environmental cues and experiences. They allow our cells to adapt to changes in the external environment without altering the underlying genetic code. For instance, exposure to stress, diet, or toxins can induce epigenetic changes that modulate gene expression, influencing an organism’s adaptability to its surroundings.

Genomic Stability:

Epigenetic regulation plays a crucial role in maintaining genomic stability. By silencing repetitive elements within the genome and ensuring accurate DNA replication during cell division, epigenetic mechanisms contribute to the prevention of mutations and chromosomal instability. This function is fundamental for the preservation of genetic integrity across generations.

Disease Dynamics:

The dysregulation of epigenetic processes is increasingly recognized as a key player in various diseases, including cancer and neurological disorders. Aberrant DNA methylation, histone modifications, and non-coding RNA expression can contribute to the initiation and progression of diseases by disrupting the average gene expression patterns. Understanding these epigenetic alterations opens avenues for developing targeted therapies for various illnesses.

Adaptive Evolution:

Epigenetic changes can be reversible and heritable, providing a mechanism for adaptive evolution. While genetic mutations drive long-term evolutionary changes, epigenetic modifications can confer rapid adaptations in response to environmental pressures. This flexibility allows organisms to adjust their gene expression profiles without waiting for genetic mutations to occur.

Inheritance Beyond DNA:

Contrary to the conventional notion of genetic inheritance, epigenetic modifications can be passed from generation to generation. This phenomenon, known as epigenetic inheritance, enables traits acquired during an organism’s lifetime to be transmitted to its offspring. It adds a layer of complexity to our understanding of inheritance, suggesting that acquired characteristics may be more than just anecdotal footnotes in the genetic narrative.

Understanding the role of epigenetic regulation not only enhances our comprehension of fundamental biological processes and opens up new avenues for therapeutic interventions. As researchers continue to unravel the epigenetic code and its implications, the prospect of manipulating these molecular orchestrators holds immense promise for treating diseases and advancing personalized medicine. Epigenetics, with its capacity to bridge the gap between genetics and the environment, invites us to appreciate the intricate symphony of life and the molecular ballet that unfolds within each of our cells.